Credit cards are now a fundamental tool for making transactions. Whether online, over the phone, or in-person, eliminating the need to carry cash. They facilitate seamless payments globally and provide consumers with purchase protection and rewards programs. However, this convenience also brings the threat of credit card fraud.

According to a report, credit card payment fraud affected 52 million Americans in the past year alone. The median amount of unauthorized charges is nearly $100. This led to a total of approximately $5 billion in criminal transactions.

Corporate hotel bookings involve large sums and sensitive data. This demands strict security measures to safeguard credit card details. While external data breaches are beyond control, strengthening security can lower fraud risks.

Ensuring secure credit card payments for corporate hotel bookings requires a multi-faceted approach. This blog explains the key strategies you can implement to ensure secure credit card transactions.

Why is Card Payment Security Important During Hotel Bookings?

Card payment security is crucial during corporate hotel bookings to protect financial information from fraud and theft. Secure transactions prevent unauthorized charges and financial losses for the company. They also keep the personal information of corporate travelers safe, maintaining their trust and privacy. Secure credit card payment methods reduce the risk of data breaches, which can lead to costly legal problems and hurt the company’s reputation.

By focusing on payment security, companies show they care about protecting their money and employees. This helps make travel arrangements smoother and more reliable.

Benefits of Using Credit Cards for Hotel Bookings

Here are some benefits of booking hotel through credit cards:

Convenience

Credit cards provide a quick and easy way to make hotel payments, streamlining the booking process. You can do an online cc payment or over the phone without cash or bank transfers.

Security

Credit cards offer enhanced protection against fraud with built-in security features like encryption, tokenization, and fraud monitoring. Many also offer zero-liability policies for unauthorized transactions.

Rewards

Credit cards allow you to earn rewards such as points, miles, or cashback on your spending. These rewards can be redeemed for future travel, hotel stays, or other purchases, providing added value.

Dispute Resolution

Credit cards offer robust dispute resolution processes. If you encounter unauthorized charges or billing errors, you can dispute them, and the credit card company will investigate and often refund the disputed amount during the investigation.

Record Keeping

Credit card statements provide detailed records of all transactions, helping you track and manage your travel expenses. This is particularly useful for business travelers who need to keep accurate expense reports.

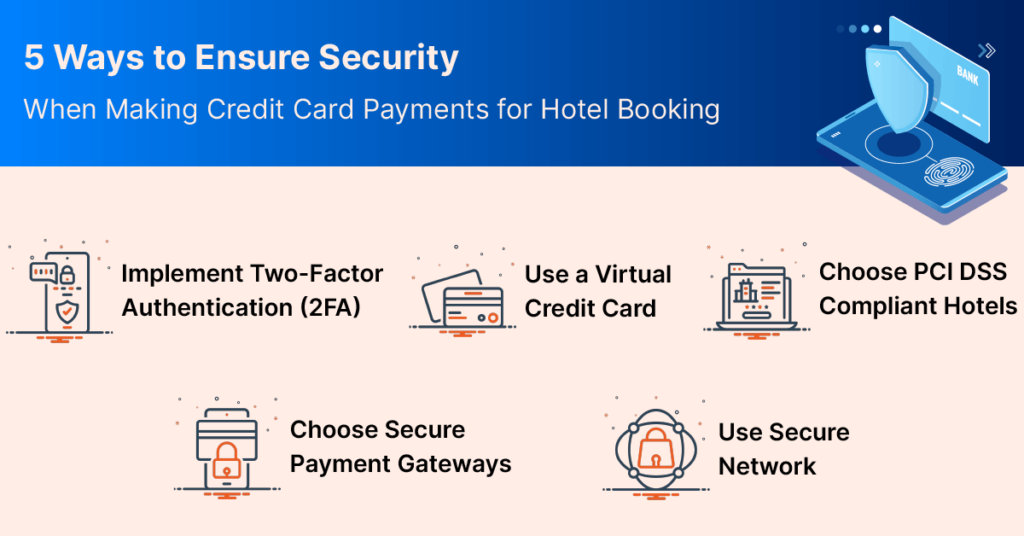

5 Ways to Ensure Security When Making Credit Card Payments for Hotel Booking

1. Implement Two-Factor Authentication (2FA)

Two-factor authentication (2FA) secures cc payments for corporate hotel bookings by requiring two verification steps: the user’s credit card details and a one-time code sent to their mobile device. This dual verification reduces the risk of fraud by ensuring that even if the credit card details are compromised, unauthorized transactions are less likely.

SMS Codes

How It Works: After entering credit card details, users receive a one-time code via SMS on their registered mobile number. They must enter this code to complete the transaction.

Advantages: Simple to use and widely accessible, as most users have mobile phones.

Authentication Apps

How It Works: Users install an app, such as Google Authenticator or Authy, on their mobile devices. The app generates time-based one-time passwords (TOTPs) that users must enter to verify their identity.

Advantages: Provides higher security than SMS codes, as it is not vulnerable to SIM swapping.

2. Use a Virtual Credit Card

Securing credit card payments for corporate hotel bookings can be enhanced through virtual credit cards. These temporary, randomly generated card numbers issued for specific transactions provide security beyond traditional credit cards.

By Using Virtual Credit Cards

Reduced Exposure

Actual credit card details are not shared with the hotel, reducing the risk of unauthorized use or data breaches.

Transaction Limits

Companies can set specific spending limits and expiration dates for each virtual card, ensuring control over expenses and preventing overcharges.

Enhanced Tracking

Detailed transaction records associated with each virtual card simplify reconciliation and auditing processes.

Fraud Prevention

Virtual cards are typically single-use or limited to specific merchants, minimizing opportunities for fraudulent activities.

Integration

Virtual card solutions often integrate seamlessly with corporate booking systems and expense management tools, streamlining the cc payment process while maintaining security standards.

Suggested Read:

How do itilite Corporate Card works?

3. Choose PCI DSS Compliant Hotels

Choosing hotels compliant with PCI is crucial for securely handling credit card data during corporate bookings. These hotels follow strict rules to protect cardholder information from theft and fraud.

PCI DSS (Payment Card Industry Data Security Standard) helps reduce the risk of fraud by preventing data breaches. Businesses that fail to comply with the latest PCI DSS regulations risk exposing their customers’ financial information and could incur substantial fines.

These hotels use strong security measures, such as encrypting sensitive data and setting up secure networks. By sticking to PCI, hotels show they’re serious about keeping credit card transactions safe. This protects corporate travelers from losing money to fraud and builds trust between the company and the hotel.

When picking PCI DSS-compliant hotels, company owners should check if they follow the rules from trusted sources or have certifications. It also helps to include PCI requirements in contracts with hotels. This ensures everyone knows what’s expected for keeping data secure.

4. Choose Secure Payment Gateways

Secure cc payment gateways are essential for safe credit card transactions during corporate hotel bookings. Reputable credit card payment gateways have advanced security features that protect financial information from fraud and unauthorized access.

Key Security Features of Payment Gateways

Data Encryption

Secure credit card payment gateways encrypt credit card data during transmission, making it unreadable to unauthorized parties.

Tokenization

They replace sensitive card details with unique tokens, which reduces the risk of data breaches by preventing actual card data from being exposed.

Fraud Detection

Advanced fraud detection systems monitor transactions in real-time, identifying and flagging suspicious activities to prevent fraudulent charges.

Compliance

These gateways comply with PCI DSS standards, ensuring they meet stringent security requirements for handling credit card information.

Secure Authentication

They support two-factor authentication (2FA), which requires a second form of verification to add an extra layer of security.

By choosing reputable credit card payment gateways with these features, companies can significantly reduce the risk of fraud and data breaches, ensuring that corporate hotel bookings are processed securely and efficiently. This enhances trust and reliability in the payment process, protecting the company and its employees.

5. Use Secure Network

To protect your financial information, make cc payments only on secure, private networks. Public Wi-Fi networks are often unsecured and can be easily intercepted by hackers, putting your sensitive data at risk.

Always use a trusted, password-protected network for transactions, such as your home or office internet connection.

Additionally, consider using a Virtual Private Network (VPN) to encrypt your internet connection, adding an extra layer of security. By avoiding public Wi-Fi and opting for secure networks, you significantly reduce the risk of unauthorized access to your credit card information.

Suggested Read:

What is a Corporate Credit Card

Some Other Things to Be Aware of to Tighten Credit Card Security

- Phishing Scams: Verify the authenticity of emails and websites before entering credit card details.

- Skimming Devices: Inspect card readers for signs of tampering before use.

- Weak Passwords: Use strong, unique passwords and update them regularly.

- Unencrypted Transactions: Ensure payment websites are secure, as indicated by “https://” in the URL.

- Unverified Merchants: Only make credit card payments to reputable and trusted merchants.

- Over-the-Phone Payments: Verify the recipient’s identity before providing credit card information.

- Data Breaches: Monitor statements regularly and use alerts to detect unauthorized transactions.

- Stored Card Information: Limit where your credit card information is stored online.

Partner with itilite to Secure Hotel Bookings

Partnering with itilite ensures secure hotel bookings through advanced travel management software with robust gateway security measures. itilite employs a sophisticated network security architecture with multiple secure zones.

Access controls are strictly enforced, using role-based access and two-factor authentication to monitor and limit access effectively. Comprehensive audit trails provide further oversight and accountability.

The corporate travel management platform is fully PCI DSS compliant, ensuring all credit card transactions are secure and meet industry standards. By using itilite credit cards for bookings, businesses gain added protection against fraud.

With itilite, you get streamlined travel management and peace of mind. Your corporate hotel bookings are handled securely and in compliance with the highest security standards.

and then

and then