Employee expense reimbursement makes up for a large portion of the work for finance teams worldwide. Ask any finance manager, and she will tell you how critical it is to set up the right expense reimbursement process in your organization. Done right, it will save you money, effort, and time and will create a great employee experience, leading to happier and more productive teams.

A process this important must be understood properly before you implement it. So, we have put together this guide that will walk you through types of expenses, IRS guidelines, and the best practices to manage employee expense reimbursement like a pro.

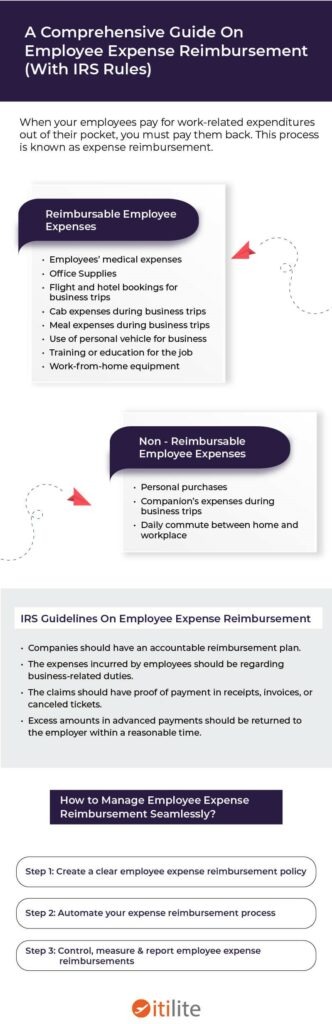

But before that, here is an infographic to give you a sneak peek of what’s in store for you.

The Basics of Employee Expense Reimbursement

When employees pay for business travel expenses or other work-related expenditures out of their pocket, the employer has to pay that money back to the employee. This process is known as expense reimbursement.

For instance, when employees go on a business trip, they will incur expenses like flight and hotel bookings, meal consumption, and daily commute. They pay for these expenditures out of their pocket, which you need to reimburse later.

Expenses made by an employee can be reimbursable or non-reimbursable, as categorized in your company’s expense policy.

Types of Reimbursable Employee Expenses

All expenses an employee bears for business-building activities can be categorized as reimbursable expenses. They are majorly classified into three main categories:

1. Auto Mileage & Travel Reimbursement

Any work trip your employees take to build the business, such as a sales meeting or attending a work conference, comes under this category. While generally, a company books a flight, hotel, and rental car for the employee in advance, other expenses like cab and meals happen on-site. So, most of the organizations pay per diem rates in advance or reimburse the amount later.

In case of mileage reimbursement, it includes paying back the employees for using their own vehicle for traveling.

In the US, IRS recommends the standard mileage rates for employees, self-employed individuals, or other taxpayers. You can refer to that while defining the expense policy for your business. Also, to decide on your employees’ per diem travel expense, you can refer to per diem rates here as specified by the GSA.

2. Medical Expense Reimbursement

Most organizations offer employee benefits like health and medical insurance that have tax benefits associated with them. Under this, your employees get reimbursed for the money they spend on any medical treatment and hospitalization.

Depending on your country, the guidelines for medical reimbursement might vary. Some countries, like the US, have medical expense reimbursement plans defined by the relevant authorities. Companies can choose from the common HRA (Health Reimbursement Arrangement) plans to cover medical expenses for their employees.

Under the HRA, an employer determines the amount of money that will go into the plan, and the employee can ask to be reimbursed for qualified medical expenses up to the designated amount. Employers can take a tax deduction for the reimbursements made through these plans. Different types of HRAs are:

- Qualified Small Employer Health Reimbursement Arrangements (QSEHRAs)

- Individual Coverage Health reimbursement Arrangements (ICHRAs)

- Group Coverage Health Reimbursement Arrangements (GCHRAs)

3. Business Expense Reimbursement

Apart from business travel and medical reimbursement, sometimes employees also spend from their pocket on business-related costs. Expenses like office supplies, stationery used in the office, and any paid training or education taken to perform the job come under this category. Organizations also need to reimburse such expenses to their employees.

If you’re interested in estimating your potential savings, we recommend using a savings calculator tailored to employee expense reimbursement. Click here to access our savings calculator.

What are Non-Reimbursable Expenses, then?

When employees are out on a business trip, they might spend money on something that is not work-related. For example, buying a souvenir on a business trip or attending a jazz concert on Saturday evening. These expenses are purely for personal purposes, and hence companies are not liable to reimburse them. These are non-reimbursable expenses.

One question that most of you might have by now would be how companies decide what type of expenses should be reimbursed. For this, most countries have guidelines that help businesses draft an employee reimbursement plan.

For instance, companies in the US have to abide by the IRS (Internal Revenue Service) guidelines for expense reimbursement plans, and there are HMRC criteria for companies in the UK. Let’s understand the IRS guidelines in detail in our next section.

IRS Guidelines: Have an Accountable Employee Expense Reimbursement Plan

As per the IRS guidelines, companies must have an accountable plan to reimburse employee expenses, in the absence of which expenses are considered as earned wages and are taxable in the US. The reimbursable expenses covered under the accountable plan should meet these criteria, as explained in the IRS Publication 15, Circular E, Employer’s Tax Guide.

- The expenses done by the employee must be connected with business-related duties.

- The expenses have to be substantiated with proof of payment in receipts, invoices, or canceled tickets or deemed to be substantiated (such as per diem rate) within a reasonable period.

- For expenses paid in advance, the employee must return any excess amount within a stated reasonable period.

Now that the basics are covered, let’s talk about how you can handle employee expense reimbursement like a pro!

How to Manage Employee Expense Reimbursement Seamlessly?

Follow these 3 steps to set up a smooth employee expense reimbursement process in your organization:

Step 1: Create a clear employee expense reimbursement policy

Understanding any process is the first step to its effective implementation. A well-defined expense policy clearly lays out the reimbursement process with timelines, explains what is considered as a reimbursable expense, defines approval flows, do’s and don’ts for all stakeholders, guides on managing exceptions, and much more.

This rule book guides the organization through the overall process. So, it is important to get the policy right. To learn how to create an expense policy for your organization, read this guide.

Pro-tip: Just having a policy in place isn’t enough. To ensure successful policy implementation, you will need to automate it using good integrated T&E software like ITILITE.

Step 2: Automate your expense reimbursement process

A manual reimbursement process is inefficient, time-consuming, and frustrating for all stakeholders involved – finance teams, employees, and business leaders.

First, the employees have to collect physical copies of each receipt and file multiple claims, one by one, on a spreadsheet. Afterward, the finance team must review each claim to determine its validity. This process is strenuous and involves a lot of back and forth between employees and the finance team.

Hence, automation is the key to making reimbursements simple, efficient, and delightful for everyone. It saves time, effort, and money for the company and creates a seamless process adopted by teams easily.

Pro-tip: While choosing expense management software, do go for an integrated travel & expense solution to get complete visibility on spend data across all categories. It will help you save up to 30% of business costs by just plugging in leakages.

Step 3: Control, measure & report employee expense reimbursements

Look at employee expenses as a metric to review spend trends, identify cost-saving opportunities, build strategies and establish goals. Expense management software solutions that offer granular data insights and complete data visibility help you do all these things while ensuring 100% policy compliance by your employees.

Ready to automate your employee expense reimbursement process? Here is the list of features you should look into while choosing the right expense management software for your organization:

- Easy-to-use expense management software with a mobile app for easy filing

- Automatic smart notification feature for faster book closing

- Flexibility and intuitive interface to configure custom policy and approval flows

- Digital audit trails for complete visibility of approvals

- Intuitive dashboard with powerful analytics for complete visibility

Suggested Read:

Streamline your Employee Expense Reimbursement Process

When employees pay for work-related expenses, you must reimburse them in accordance with IRS guidelines. This comprehensive guide can help you understand the nitty-gritty of employee expense reimbursement and create an efficient expense policy.

However, you need expense management software like ITILITE to ensure the expense policy is implemented correctly. The ITILITE platform offers easier expense filing, better policy compliance through audit and fraud detection, dashboards and reports to increase spend visibility, and an integrated corporate travel management software solution.

ITILITE Lunch and Learn : If you would like to know more, come meet us in your city. Join us for our “Top Tier Travel Talks” Lunch Seminar.

and then

and then