Various specialised practices have evolved in the accounting world to serve different purposes. Cost accounting and financial accounting are two of the most fundamental branches. Both are essential for business operations but serve distinct roles and audiences.

This blog will explore the differences between cost accounting and financial accounting. It will look at their functions, methods, and uses. Understanding these differences will help businesses use these accounting practices more effectively to reach their financial goals.

Introduction to Cost and Financial Accounting

Accounting is the process of recording, classifying, summarising, and interpreting financial transactions. However, this broad definition includes several specialised fields, each with its own focus and methods. Cost accounting and financial accounting are two such fields. They often need clarification because they overlap but have distinct objectives and uses.

Understanding the difference is essential for anyone managing a business’s finances. Each type of accounting offers unique insights that help contribute to the company’s success.

What is Cost Accounting?

Cost accounting focuses on a company’s internal processes. It provides detailed information to help management with production, pricing, budgeting, and control. It’s a tool for managers to improve operations and cut costs.

What is Financial Accounting?

Financial accounting is geared toward external stakeholders. It includes investors, creditors, and regulatory bodies. It involves preparing financial statements that reflect the company’s economic health. These statements must adhere to standard accounting principles. It must provide a comprehensive view of the company’s financial performance over a specific period.

What is The Difference Between Cost Accounting and Financial Accounting?

Cost accounting focuses on tracking, analysing, and controlling costs. It is associated with a company’s operations. The primary goal is to provide cost details for optimising business efficiency and profitability. Cost accounting involves collecting and assigning costs to various products, services, or projects. Companies can make informed decisions on pricing, budgeting, and cost control by understanding production costs. It is beneficial for manufacturing and service-oriented industries. In these industries, monitoring costs is critical to maintaining competitive pricing and profitability.

On the other hand, financial accounting is concerned with the broader financial picture of an organisation. It involves preparing and presenting financial statements. These include the income statement, balance sheet, and cash flow statement. These reflect a company’s overall financial performance and position. Financial accounting follows standardised rules and guidelines. These include Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). The standards ensure that financial information is consistent and comparable across different organisations. This type of accounting primarily aims to provide external stakeholders with an accurate and fair view of the company’s financial health.

The difference between cost accounting and financial accounting lies in their focus and purpose. Cost accounting helps management make strategic decisions related to cost control and efficiency. Financial accounting is externally focused. It ensures that a company’s financial performance is accurately reported to outside parties. Both are crucial to a company’s success but serve different audiences and purposes.

Understanding the Purpose and Objectives

The primary difference between cost accounting and financial accounting lies in their purpose and objectives:

1. Purpose of Cost Accounting

- Internal Decision-Making : Cost accounting is mainly utilised for decision-making purposes. It helps managers understand the company’s cost structure and pinpoint areas for improvement.

- Cost Control : One of the main objectives of cost accounting is to control costs by identifying cost drivers and eliminating waste.

- Budgeting and Forecasting : Cost accounting aids in budgeting by providing detailed cost information. This helps set realistic financial goals and forecasts.

2. Purpose of Financial Accounting

- External Reporting : Financial accounting focuses on providing accurate financial information to external stakeholders. It ensures investors, creditors, and regulators understand the company’s financial position.

- Compliance and Accountability : Financial accounting ensures the company meets accounting standards and legal requirements. This accountability is essential for maintaining trust with stakeholders.

- Performance Evaluation : Financial accounting provides a broad overview of the company’s economic performance. Thus enabling comparisons over time and against industry benchmarks.

Methods and Techniques

The methodologies employed in cost accounting and financial accounting also highlight the distinction:

1. Cost Accounting Methods

- Job Costing : This method assigns costs to specific jobs or batches of products. Thus, making it ideal for companies that produce customised goods or services.

- Process Costing : They are used in industries where continuous production and units are indistinguishable.

- Standard Costing : This involves setting standard costs for products and services. It also includes comparing them with actual costs to identify variances.

2. Financial Accounting Methods

- Accrual Accounting : Financial transactions are recorded when they are incurred. They are not when cash is exchanged. This method provides a more accurate picture of a company’s financial health.

- Cash Accounting : It records transactions only when cash changes hands. This method is more straightforward but less informative for evaluating long-term financial performance.

- Double-Entry System : Every transaction is recorded twice, once as a debit and once as a credit. This ensures that the accounting equation (Assets = Liabilities + Equity) always balances.

- Historical Cost Accounting : Assets and liabilities are recorded at their original purchase cost. This provides a consistent and verifiable record of transactions.

Reporting and Analysis

Another key difference between cost and financial accounting lies in their reporting formats and analysis.

1. Cost Accounting Reports

- Detailed and Frequent : Cost accounting reports are more detailed and are generated more frequently. This is to support ongoing operational decisions.

- Internal Focus : These reports are meant for management’s internal use. They often include sensitive data such as material costs, labor, and overheads.

- Variable Costing and Contribution Margins : Cost accounting often includes reports on variable costs and contribution margin. These are crucial for pricing and production decisions.

2. Financial Accounting Reports

- Standardised and Periodic : Financial accounting reports are standardised and typically prepared quarterly or annually.

- External Focus : These reports are intended for external stakeholders and must comply with accounting standards like GAAP or IFRS.

- Summarised Data : Financial accounting focuses on summarising data to provide a broad overview of the company’s financial status rather than the granular details in cost accounting.

Regulatory Requirements

Regulation and compliance are areas where the difference between cost accounting and financial accounting becomes particularly pronounced:

1. Cost Accounting

- Flexible and Non-Regulated : External bodies generally do not regulate cost accounting, allowing companies to design their cost accounting systems according to their specific needs. The focus is on internal efficiency and decision-making.

- Customisable : Since no strict regulatory standards exist, companies can customise their cost accounting practices to align with their operational processes and management goals.

2. Financial Accounting

- Highly Regulated : Financial accounting is subject to strict regulations, such as GAAP or IFRS. These regulations guarantee consistency, transparency, and the ability to compare across various companies and industries.

- Auditable : Financial statements prepared under financial accounting principles must be auditable by external auditors to ensure accuracy and regulation compliance. This auditability is critical for maintaining the trust of investors and other stakeholders.

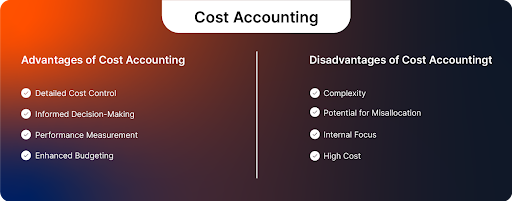

Advantages and Disadvantages of Cost Accounting and Financial Accounting

Now that we know the difference between cost accounting and financial accounting, let us see the advantages and disadvantages:

Advantages of Cost Accounting

- Detailed Cost Control : Cost accounting analyses costs associated with various aspects of a business. This detailed insight helps management identify areas where costs and resources can be optimised. Thus, leading to better cost control.

- Informed Decision-Making : By breaking down costs into various components, cost accounting aids in making informed decisions. These decisions involve pricing, budgeting, and investment. Cost accounting enables managers to understand the profitability of individual products or services. Hence allowing them to adjust strategies accordingly.

- Performance Measurement : Cost accounting allows businesses to measure the efficiency and productivity of different departments or processes. Tracking costs against benchmarks helps companies spot underperformance and take corrective action.

- Enhanced Budgeting : With accurate cost data, cost accounting supports more precise budgeting and forecasting. This helps in setting realistic financial goals and managing resources effectively.

Disadvantages of Cost Accounting

- Complexity : Implementing and maintaining a cost accounting system can be complex and time-consuming. It requires detailed cost tracking and may involve sophisticated software and trained personnel.

- Potential for Misallocation : Budget allocation in cost accounting can sometimes lead to inaccurate cost distribution across products or departments. This results in a skewed profitability analysis.

- Internal Focus : Cost accounting is primarily used for internal decision-making. The information it provides may need to be more helpful and understandable to external stakeholders.

- High Cost : Setting up and operating a cost accounting system can be expensive, especially for small businesses, as it may require significant investment in systems and personnel.

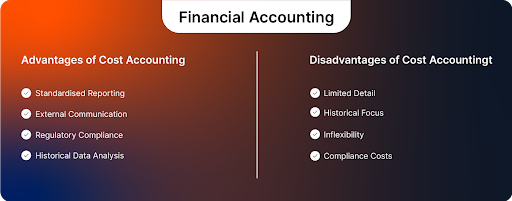

Advantages of Financial Accounting

- Standardised Reporting : Financial accounting follows set rules like GAAP or IFRS. Hence, ensuring consistent and comparable financial information across organisations. This standardisation is crucial for stakeholders to assess a company’s financial health.

- External Communication : Financial accounting provides essential financial statements. External stakeholders use these documents to make informed decisions about the company.

- Regulatory Compliance : Financial accounting ensures companies comply with legal and regulatory requirements. Following standardised accounting practices helps businesses avoid legal penalties and stay compliant.

- Historical Data Analysis : Financial accounting records a company’s performance. This enables trend analysis and long-term planning.

Disadvantages of Financial Accounting

- Limited Detail : Financial accounting provides a broad overview of a company’s financial status but lacks detailed insights into specific cost components or departmental performance. This can limit its usefulness for internal management purposes.

- Historical Focus : Financial accounting primarily concerns past financial data, which may not always be relevant for real-time decision-making or future planning.

- Inflexibility : Financial accounting’s standardised nature can make it less flexible in adapting to specific business needs or unique financial situations. It may not capture the nuances of complex business operations.

- Compliance Costs : Adhering to financial accounting standards and regulations can be costly, especially for smaller companies. The need for audits, specialised accounting personnel, and compliance measures can add to the financial burden.

The Bottom Line: The Importance of Understanding Cost Accounting and Financial Accounting

In conclusion, understanding the difference between cost accounting and financial accounting is crucial for anyone in business. While they serve different purposes, both are indispensable for providing the insights needed to drive a company’s success.

- For Managers : Grasping the nuances of cost accounting allows for better control over operations and resource allocation. Hence, leading to more informed decisions that enhance profitability and efficiency.

- For Investors and Stakeholders : Understanding financial accounting ensures you can accurately assess a company’s financial health. Companies can make informed investment decisions.

- For Accountants : Mastering cost and financial accounting is essential for thorough economic analysis. These disciplines meet internal and external needs.

Businesses must use cost and financial accounting to grow, optimise resources, and stay compliant in complex financial situations. Understanding the difference between cost and financial accounting helps you make better financial decisions. Thus, leading to long-term success and stability.

Cost and financial accounting focus on different areas, but they work together. Each offers valuable insights, giving a full view of a company’s financial health. Understanding their differences helps businesses use both tools effectively. This helps in aligning daily operations and long-term strategies for the best results.