An expense report is a necessity for any employee who wants to claim reimbursement for any expense they have incurred for business purposes such as meals or mileage. Also, it is essential for businesses as it helps track expenditure and file taxes efficiently.

Lets’ see what exactly an expense report is, its benefits, and how to create one. Also, you can download a customizable expense report template that you can use for your company.

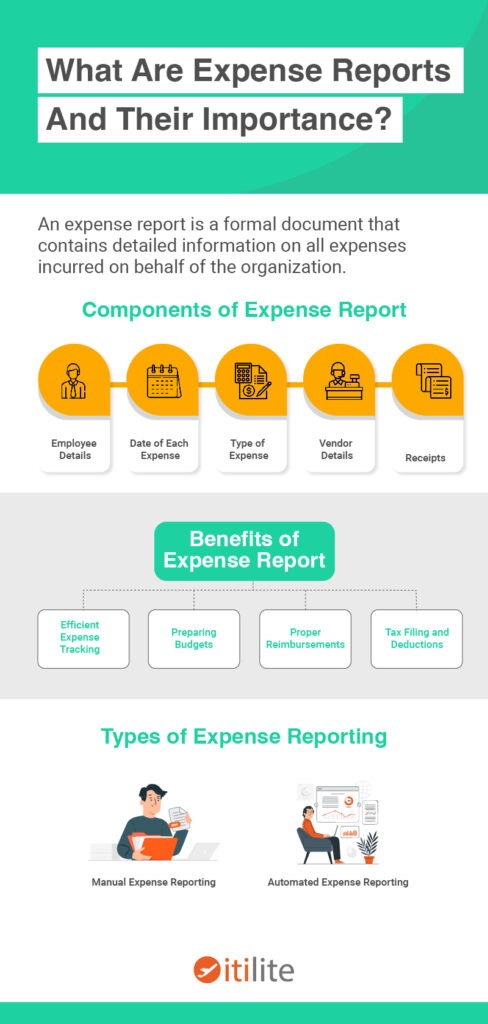

What is an Expense Report?

An expense report is a formal document (paper or digital) that itemizes all expenses incurred during the course of performing job functions.

For instance, if an employee is traveling for a business conference, she would use some means of transport, and incur many expenses during the trip such as meals, accommodation, and client meetings.

All of these may be included in the report and be reimbursed as per the company T&E policies. The policies entail the spending limits for each type of expense and what happens if they spend out of policy.

Sections of an Expense Report

An expenses report typically has the following sections or columns:

- Employee details – The information of the employee who is filing reimbursement such as her name, department, designation, etc.

- Date of each expense – The date when the item was purchased. This should match with the date on the attached receipt

- Type of expense – There can be different expense categories as per your travel and expense policies such as transportation, accommodation, and incidental expenses. Read what can and cannot be claimed as business travel expenses here.

- Vendor details – The name and details from whom the item was purchased

- Receipts – Proof of expense such as bills or invoices. Employees can state if they have attached the receipts or not

- Cash advances paid to the employees

- Value (sub-total) of each expense category – The total amount spent under each expense category

- The total expense amount to be reimbursed – The total amount to be paid back to employees after the addition of taxes and deductions

Employees who often pay out-of-pocket for business expenses need to submit expense reports to claim reimbursements within a particular time frame, as per the T&E policy.

Expense reports are usually generated on a monthly, quarterly, or annual basis. Monthly and quarterly reports keep a track of all business spending your company has made within that period. Whereas a yearly report is used for deducting expenses on tax returns.

Benefits of Expense Reports

Generating expense reports helps in:

1. Efficient Expense Tracking

The expense reports help in tracking the overall spending of the company. You can see how much your employees are spending for different expense categories such as meals, incidental expenses, etc. They can see the expenses that are driving the costs up and strategize on how to reduce them.

2. Preparing Budgets

When employees submit a detailed and accurate expenses report, you get an idea about creating a strong financial plan for your business. It gives you visibility on which departments would require more budget allocation.

Also, you can check if the departments are adhering to the allocated budgets to keep your business on the right track, financially.

3. Proper Reimbursements

Since expense reporting becomes a standardized process of expense management, employees are aware of the expenses that can be or cannot be reimbursed. This helps in the proper expense filing.

Also, since employees lay down all the details of the expenses along with the receipts, it becomes easier for finance managers to check if the expenses are legitimate.

4. Tax Filing and Deductions

Expense rereports help in keeping track of the deductible expenses that can be used to file taxes, at the end of the year.

Types of Expense Reporting Processes

The expense reporting process can be manual or automated; we have explained both of them in detail here:

1. Manual Expense Reporting with Templates

Since, creating expense reports manually is a tedious task, some businesses provide their employees with customizable expense report templates that can help them prepare reports in PDF or spreadsheets.

Certain businesses have some mandatory columns to be filled by employees in the expense report. The employees fill in all the expense details (as mentioned in the first section), attach corresponding receipts, and send them to their manager for approval.

The manager, then, checks if there are any policy violations or fraudulent claims. After approving it, the manager sends the report to the finance team for reimbursement.

2. Automated Expense Reporting

An automated expense management software such as ITILITE, your employees can generate expense reports in a few clicks. They can capture the receipts digitally and later, the expense data can be extracted from the receipts to create expense reports.

Moreover, they can connect their credit/debit card or corporate card to the software for reconciliation and re-check easily all the expenses. They can then send the reports for approval to their managers.

The managers can check if there are any warnings or alerts regarding policy violations. The approved expense reports are automatically sent to the finance team for reimbursements. You can track and manage all the reports effectively. Also, you can save a lot of time and money with expense management automation.

How to Create an Expense Report

Here’s a step-by-step guide on how you or your employees can create expense reports:

1. Choose a Template or Software

To create an expense report, the first step that your employees will take is to either select an expense report template or expense management software. After that, they can download the template and customize it as per your company’s needs.

To save time as your business and the expenses grow, you can integrate expense management software. Add all the corporate cards to it so that expenses are added automatically as your employees make the spending.

2. Edit Columns

Whether your employees download a template from the internet or use the one your expense management software offers, they will need to add or change columns as per their expenses. They might or might not need the “incidental expenses” column.

3. Add All Expense Categories Separately

Ask employees to add each expense category in a new row and with as much detail as possible. Also, ensure that your employees add the client name or the project name for easier expense tracking.

4. Add Total Amount

Each expense category will have a subtotal amount. Your employees will need to make a grand total of all the expenses, including the taxes and subtracting advances (if paid by the company).

5. Attach Receipts

Employees will absolutely need to attach receipts of all the expenses incurred for business purposes. However, if they are submitting the reports manually, they will have to take a printout of the expense report and attach the photocopy of all the receipts. On the contrary, if they submit the expenses electronically, the receipts can be scanned and be attached as files.

Attaching receipts is necessary for reimbursements. Know everything about accountable reimbursement plans here.

6. Send the Report for Approval

This is the final step. After your employee has created the expenses report, he or she needs to share them with their managers for approval either in person or electronically, or via the expense management software.

Free Expense Report Template

Having a neat expense report template with clearly demarcated sections for each expense type can make the expense reporting as well as the reimbursement process easier. Here’s a free expense report template that you can share with your employees for submitting expense reports.

Get Free Expense Report Template

Automate Expense Filing with ITILITE

Is manual expense filing taking a lot of your employees’ time? Manual expense reports are a thing of the past.

ITILITE offers a SaaS expense management platform with automatic digital expense creation. All the employees need to do is upload their receipts in the ITILITE mobile app or website, and all the fields from the receipt get auto-populated to the report. This leads to no fuss and error-free expense filing for employees.