“NDC represents a leap forward in how airlines distribute their products, providing more flexibility and a broader set of options to consumers beyond just price.”

-Pam Zager, EVP of Operations at World Travel, Inc.

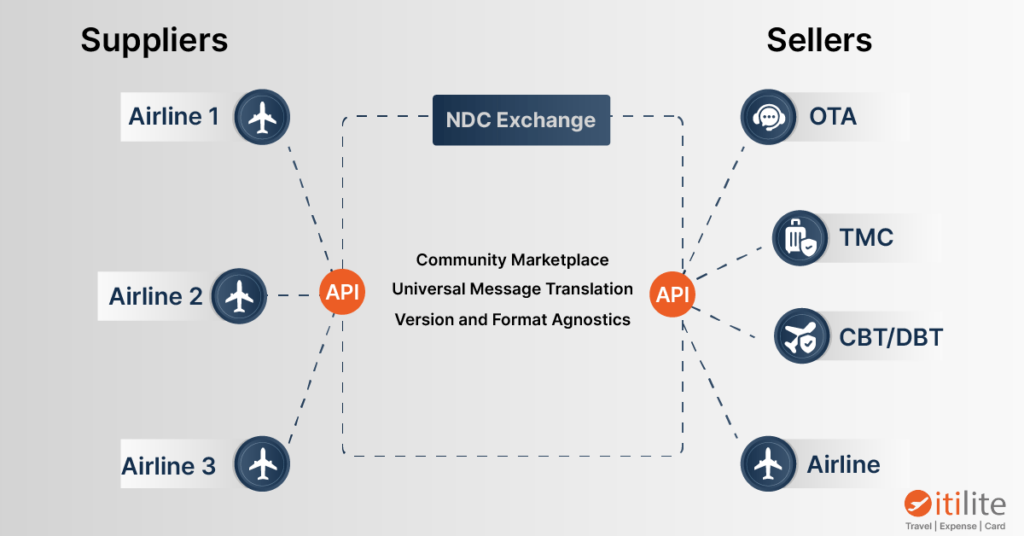

New Distribution Capability (NDC) is an initiative led by the International Air Transport Association (IATA) to modernize the retailing of air travel products. NDC seeks to transform airline distribution from a static content model to one that offers dynamic and personalized options. This shift addresses the rigidity that has historically hindered airlines’ ability to differentiate their offerings and deliver tailored experiences to travelers. By leveraging modern technology, NDC enhances airlines’ capability to present unique and customized travel solutions, improving the overall customer experience.

New Distribution Capability (NDC) is a boon for airlines, allowing them to offer a broader range of fares and options (including add-ons like seat selection or checked baggage) directly through online travel agencies, reservation systems (GDSs), and corporate travel management companies. The NDC adoption in the airline industry is experiencing a digital revolution. This technology replaces outdated methods with a modern, XML-based communication standard.

However, travel agents who still need to upgrade their technology to support NDC risk missing out on a significant portion of this content. For instance, in April 2023, American Airlines made nearly 40% of its fares bookable only through NDC channels, leaving non-upgraded agents needing access to these offerings for their clients. In April 2023, American Airlines caused a stir in the travel industry by migrating nearly 40% of its fares exclusively to New Distribution Capability (NDC) channels. This move impacted travel agents who hadn’t yet upgraded their technology, as they could no longer access those fares for their clients.

In another blog, we discussed the challenges of NDC integration; this time, we’ll discuss the consequences of not integrating NDC (New Distribution Capability).

NDC Adoption: A Slow Climb Transforming Airline Distribution

The New Distribution Capability (NDC) standard has been simmering in the airline industry for over a decade. Introduced by the International Air Transport Association (IATA) in 2012, NDC aimed to revolutionize how airlines distribute their products and services. It expected a shift from the traditional screen-scraping methods that Global Distribution Systems (GDSs) employed to a more dynamic, XML-based communication protocol.

The early years of NDC adoption in the airline industry could have been faster. Airlines, GDSs, and travel agencies had to adapt their technology and processes to this new standard. Airlines were hesitant to embrace NDC fully and were concerned about development costs and potential disruption to existing workflows. GDSs, who held a dominant position in airline distribution, viewed NDC as a potential threat to their business model.

However, the tide has begun to turn in recent years. Several major airlines, including American Airlines, Lufthansa, and British Airways, have made strides and successfully implemented NDC. They have reaped the benefits of NDC in offering a wider range of fares and personalized offers directly to travel agents and even directly to consumers. This has allowed them greater control over product differentiation, pricing strategies, and the ability to bundle fares with ancillaries like baggage fees or seat selection.

The travel industry is also starting to adjust. Travel agencies increasingly recognize the need to upgrade their technology to support NDC bookings. Consortiums and technology providers are offering solutions to ease the transition for agencies. While GDSs are still a major player, they also adapt and integrate NDC capabilities into their platforms.

The future of NDC adoption holds immense potential. While significant progress has been made, challenges persist. The technical complexity of NDC implementation and the fragmented nature of the travel industry can present hurdles. However, the potential benefits for airlines, travel agencies, and travelers are undeniable and promising. As technology evolves and the industry adapts, NDC adoption will likely accelerate, transforming how airlines distribute their offerings and creating a more dynamic and personalized travel experience.

American Airlines and New Distribution Capability

AA’s NDC plans include selling dynamically priced fares, Introducing bundled fares and ancillaries, Making basic economy fares only available in NDC, and Paying commission on NDC bookings.

NDC has been controversial within the airline industry because it requires travel service providers to invest time and money and change their processes. However, AA says that NDC is helping to enhance the customer experience, streamline operations, and improve overall efficiency.

American Airlines (AA) has been pushing forward with its New Distribution Capability (NDC) initiative since early 2023. According to Travel Weekly news, American Airlines has launched a commission program for New Distribution Capability (NDC) bookings.

The program, as reported by The Beat newsletter, pays a 10% commission for NDC-enabled bookings of American’s Main Plus, Main Select, and Flagship Business Plus bundles.

Consequences of Skipping NDC Adoption In the Airline Industry

1. Personalized Travel, Simplified

Say goodbye to generic searches! With NDC, you can save your preferences, instantly customizing search results. This means you’ll see options tailored to you, like free Wi-Fi included in your company’s corporate agreement or an extra R150 charge for leisure travelers. NDC allows airlines to leverage your shared information to create personalized offers, like a brewery tour during your Munich layover!

2. Faster Service for You, Streamlines your tasks

NDC makes booking a breeze for both you and your travel agent. Instead of navigating multiple systems, agents can now use any Global Distribution System (GDS) to pay for preferred seats, extra baggage, or special meals on your behalf. This translates to a faster and more efficient booking process, with access to a wider range of options- extra legroom, baggage fees, upgrades, and special meals – all in one place.

3. An Easy Way to Book Low-Cost Flights

The rise of budget airlines (often outside traditional booking systems) has made it harder for travel managers to track and manage airfare spending. The New Distribution Capability (NDC) allows low-cost carriers to integrate with your travel manager, who typically sells directly to customers. You can now book these budget airlines through your familiar TMC platform, giving travel managers greater visibility and control over your airfare spend.

Suggested Read:

5 Airline NDC Myths in Travel Booking

What are NDC adoption benefits?

Let us discuss the key benefits:

1. Personalization at Its Peak

One of the significant benefits of implementing NDC is the customized and smooth booking experience it offers travelers. Traditional distribution systems often fall short, providing sparse details that do not cater to individual needs. With NDC, airlines can showcase extensive content, including images, videos, and comprehensive descriptions, allowing travelers to make well-informed choices tailored to their preferences.

2. Dynamic Pricing and Customization

NDC enables airlines to introduce dynamic pricing and bundling, crafting personalized packages that can include choices like baggage handling, seat selection, and exclusive lounge access. This level of customization not only elevates the overall customer journey but bolsters customer loyalty due to enhanced satisfaction.

3. Streamlining Processes

NDC enhances the distribution framework, making it more streamlined and effective for airlines and their partners. Unlike outdated legacy systems, NDC adoption utilizes modern web technology to facilitate real-time interactions between airlines and distributors.

4. Cost Reduction and Revenue Enhancement

This improved efficacy helps airlines decrease distribution expenses while amplifying revenue prospects. Simultaneously, travel agencies and OTAs benefit from accessing more extensive, timely airline product and service data. These advancements promote better collaboration and more lucrative partnerships within the industry.

5. Ancillary Revenue Growth with NDC

Enhanced Visibility and Sale of Ancillary Services: Ancillary services play a crucial role in an airline’s revenue stream. NDC equips airlines to better promote and sell these services by allowing them to offer bundled services at the booking stage, which enhances the likelihood of purchase.

6. Targeted Upselling with Data Insights

Leveraging data and analytics, NDC aids airlines in efficiently identifying upselling and cross-selling opportunities. For instance, suggesting additional services like airport lounge access or car rentals during or after the primary booking can significantly boost ancillary revenue.

7. Differentiation in a Competitive Market

Differentiation is critical in the fiercely competitive aviation sector. NDC provides airlines with tools to distinguish their offerings by rapidly delivering more comprehensive and flexible service packages.

8. Customization for Niche Markets

Airlines can exploit NDC by tailoring offerings to specific demographic segments, such as business travelers or leisure groups, effectively targeting niche markets. This customization helps create unique selling propositions, giving them a competitive advantage in the market.

What are the Disadvantages of NDC?

Despite its numerous advantages, the journey toward successful NDC implementation is not without its challenges.

Some of the disadvantages of implementing NDC include:

- Cost—NDC can increase costs for travel management companies (TMCs), traditional leisure agencies, online travel agencies (OTAs), and other larger purchasers of air tickets. For example, bypassing Global Distribution Systems (GDSs) for NDC bookings can result in losing GDS segment incentives and penalties.

- Integration complexity—Integrating NDC into existing airline systems can be complex, time-consuming, and costly, especially for legacy carriers. Many airlines, booking tools, and TMCs operate on legacy systems not designed with NDC in mind, and retrofitting them to support NDC can be expensive.

- Standardization—Lack of standardization across the industry can hinder interoperability and create complications for travel agencies and aggregators.

- Distribution channel disruption—Critics argue that NDC has disrupted traditional booking channels, particularly the GDS, which are widely used by TMCs. Some industry stakeholders, including TMCs, have expressed concerns about potential exclusivity and preferential treatment for specific channels.

- Security and privacy concerns—Airline systems must be safeguarded against cyber threats, ensuring the protection of customer data and adherence to privacy regulations.

Impact of NDC on the Travel Industry

NDC can have several effects on different groups of people in the travel industry, including:

- Corporate travel managers– The risk of out-of-system bookings can occur when a platform fails to provide the content travelers seek, which is a significant concern. These bookings can lead to higher travel costs, reduced visibility of spend, and control over policies. The issue of care-of-duty for employers has also been raised, but companies may not be aware of the problem if they lack the necessary data tools to track them.

- For Airlines: NDC empowers airlines to regain control of their product offerings. They can showcase richer content like detailed descriptions, images, and videos, allowing travelers to make informed choices. Additionally, NDC enables dynamic pricing and custom bundles, including baggage, seat selection, and lounge access, increasing revenue opportunities.

- For Travel Agencies: While some initial adjustments are needed, NDC can significantly boost revenue. Travel agents can offer clients the most up-to-date options by streamlining airline communication and providing real-time data access. Furthermore, NDC facilitates the integration of ancillary services like seat upgrades into the booking process, potentially leading to a substantial increase in revenue for travel agencies.

- For Travelers, NDC paves the way for a more personalized travel experience. Through dynamic pricing, travelers benefit from a wider range of fare options and potentially lower prices. Additionally, NDC empowers them to choose bundled options that suit their needs, creating a more seamless booking journey.

Overall, NDC signifies a shift toward a more dynamic and data-driven travel industry, benefiting all stakeholders. As NDC adoption grows, we can expect even greater innovation and efficiency in how airlines, travel agencies, and travelers connect.

The Risks of Standing Still: the Impact of Not Implementing NDC

While NDC adoption benefits present a significant shift, the potential rewards are undeniable. However, for those who choose not to implement NDC, there are real risks:

- Limited Content and Outdated Information: Travel agencies not adopting NDC risk losing access to airlines’ latest fares and offerings. This can result in frustrated clients and missed opportunities for competitive pricing.

- Inefficient Workflows: Without NDC, travel agents may face a more time-consuming booking process, requiring them to navigate multiple channels to find the best options for their clients. This inefficiency can ultimately impact their bottom line.

- Falling Behind the Competition: As NDC becomes the dominant standard, travel agencies that have yet to adapt risk losing ground to their competitors, who can offer a broader range of options and a more streamlined booking experience.

NDC adoption (New Distribution Capability) presents a significant shift in the airline industry, offering undeniable benefits. However, agencies that do not implement NDC face several risks. First, they risk limited content and outdated information. Without NDC, travel agencies may lose access to airlines’ latest fares and offerings, leading to frustrated clients and missed opportunities for competitive pricing. Second, inefficiencies in workflows can arise. Without NDC, travel agents might have to navigate multiple channels to find the best options for their clients, resulting in a more time-consuming booking process that impacts their bottom line. Lastly, there is the risk of falling behind the competition. As NDC becomes the dominant standard, travel agencies that fail to adapt risk losing ground to competitors who can offer a broader range of options and a more streamlined booking experience.

As final thoughts, while the transition to NDC requires investment and effort, the potential rewards make it essential for travel agencies to adopt this new standard. Failing to do so could result in losing access to up-to-date information, operational inefficiencies, and a diminished competitive edge. Staying competitive is not just a goal but a necessity in the evolving travel industry.