Gone are the days when people carried cash to make payments while traveling. Cash, which was once the king, is no longer the only mode of payment. Technology advancements have paved the way for various other pay at hotel modes of payment. Consumers today have opted for more convenient modes of payment that are readily available and save time.

The same applies to business travel. Employees constantly on the go prefer to make online payments instead of carrying large amounts of cash. With the surge in business travel, online payments have become increasingly popular. This especially applies to making payments at hotels.

According to a recent survey, 54% of travelers find it difficult to make hotel payments, and some haven’t been able to make payments. Hence, this blog will discuss the intricacies of hotel payments and the various pay at hotel options.

Understanding Pay at Hotel Payments

A hotel payment refers to the financial transaction process where a guest settles their bill for accommodation and related services. Simply put, it is a payment method where guests pay at the hotel for staying in the booked room and leveraging other services, such as dining, spa, gym etc.

You pay when you arrive at the hotel or when you check out. This option offers flexibility, allowing you to confirm your booking without an upfront financial commitment. It also provides the ability to modify or cancel your reservation if needed. This payment method is particularly convenient for travelers who prefer to settle their bills in person.

What are Pay at Hotel Payments in Business Travel?

Hotel payments in business travel encompass the methods and processes business travelers use to settle their hotel bills. These payments are often facilitated by corporate travel policies and managed through travel management companies (TMCs) or corporate travel departments. The primary objectives are to ensure convenience for the traveler, control costs for the company, and maintain accurate records for reimbursement and reporting.

Business travelers typically have several payment options, each with its own advantages and challenges. The pay-at-hotel method can significantly impact the efficiency of travel expense management and the overall satisfaction of the traveler.

Pay at Hotel Payment is a Better Option?

One of the hospitality industry’s essential features is pay at hotel payments for business travelers. This flexible mode of payment lets travelers pay for their accommodation during arrival or departure instead of paying in advance. This hotel payment option provides several significant advantages, enhancing the overall travel experience for travelers and operational efficiency for hotels.

Firstly, pay at hotel payments offer greater flexibility and convenience for travelers. Business travelers often face unpredictable schedules and last-minute changes. Finalizing their hotel payments during check-in or check-out accommodates these uncertainties, reducing stress and providing a smoother travel experience.

Secondly, such a payment method enhances trust and traveler satisfaction. Business travelers appreciate having the option to inspect the hotel’s amenities and services before making the final payment. This assurance can lead to higher satisfaction rates and potentially more repeat business for hotels.

For hotels, such options can lead to higher booking conversion rates. Potential guests who might be hesitant to pay upfront are more likely to make a reservation, knowing they can pay later. This can result in increased occupancy rates and revenue.

Suggested Read:

The Right Corporate Travel Payment Solutions for Your Business

What are the Various Hotel Payment Options?

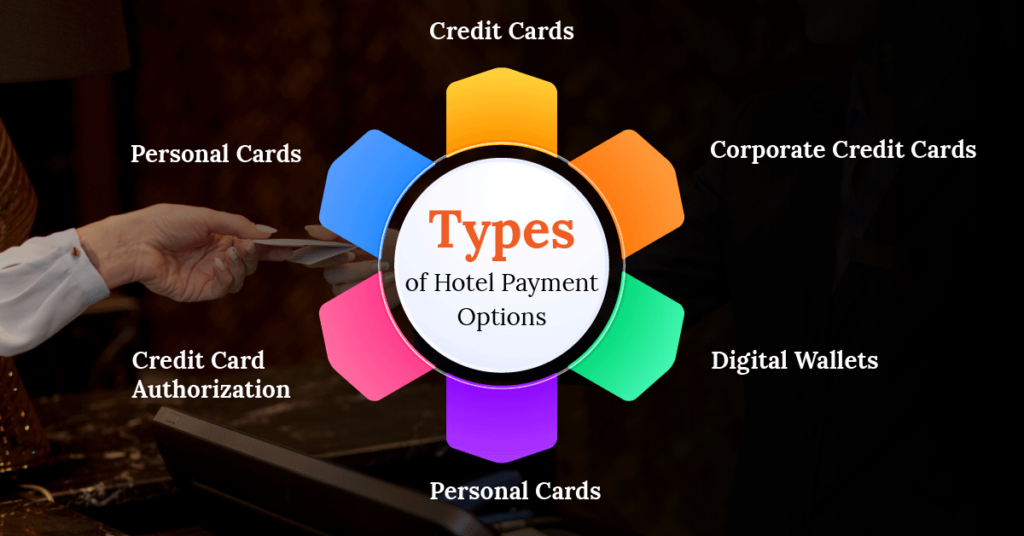

Understanding hotel payment available can significantly enhance an employee’s travel experience. Let us look at various hotel payment options that travelers can leverage. Broadly, the hotel payment options can be divided into two categories:

- Pre-Paid

- Post-Paid

Pre-Paid

Pre-paid payment options are methods for payment before using a service or product. This guarantees payment before the user uses the product or its services. The most popular payment options include:

1. Digital Wallets

One of the latest hotel payment options that has become increasingly popular is digital wallets. Digital wallets are software solutions that act as the virtual version of a physical wallet. They provide a secure and convenient way of making hotel payments. While using a digital wallet, travelers need not use cash or a credit card. All you have to do is add a certain amount to the wallet by entering your bank details. For every transaction or payment at the hotel, digital wallets provide a contactless mode of payment.

2. Pre-paid Cards

A pre-paid top-up card is a type of card that allows users to add money without any bank details. This is very different from credit and debit cards. Every time the amount gets exhausted, the card can be recharged and used for transactions. Most companies let employees use such cards to cover expenses incurred during a business trip. With such pre-paid cards, employees cannot spend more than the amount added to the card.

Post-Paid

Post-paid payment options are methods for payment after the service or product has been rendered. This often includes direct billing, deferred payment agreements, or corporate accounts, allowing customers to use the service first and pay later. Some of the post-paid options include:

1. Credit Cards

One of the most common and popular modes of payment used across the globe is credit cards. Credit cards are often issued by banks to their customers, where they can make electronic transactions. The credit card network enables the transactions between card owners and merchants through the bank. Generally, in credit cards, a certain amount limit is added and every time a transaction is made, the amount gets deducted. Credit cards eliminate the need to carry cash to make payments, thus ensuring security. Most travelers use credit cards to pay at hotels.

2. Corporate Credit Cards

Corporate credit cards are credit cards issued by a company to its employees for business expenses. The bank usually issues the card to the company and then hands it to the employee. The card will have details of both the employer and the employee. A corporate credit card allows companies to control their employees’ expenses and prevent fraud. It also allows employees to book and use it to pay at hotels.

3. Personal Cards

Personal cards are cards owned by customers/travelers for their personal use. This can include both debit and credit cards. If a company is not in the situation to offer its employees corporate cards, then employees can use their own cards. Employees can apply for reimbursement after all business transactions are made via this card. However, personal cards have their own flaws. The company may not have any control over the spending limit and can easily blur the lines between personal expenses and business transactions.

4. Credit Card Authorization

Hotels often request credit card authorization or cc auth before or during pay at hotel. This involves placing a hold on funds to cover anticipated charges like room rates and incidentals. It doesn’t immediately charge the card but temporarily reduces the available credit limit. This method suits business travelers or those who prefer to settle their bills electronically upon checkout.

Suggested Read:

Why is CC Auth Needed in Corporate Hotel Booking?

Leverage the Convenience of Pay at Hotel Options

To conclude, the evolution of pay at hotel reflects a shift towards convenience, flexibility, and security. From credit cards to digital wallets and prepaid cards, the range of payment options continues to expand. It caters to diverse traveler needs and corporate policies. As business travel dynamics evolve, so do the expectations around payment security, flexibility, and efficiency. Businesses can streamline corporate travel management processes by understanding and leveraging these payment options.

One of the best ways to ensure safe and secure hotel payments is with itilite. itilite is one of the fastest-growing and modern platforms for travel and expense management and corporate card solutions. Our one-time virtual card helps with hotel payments without compromising data and providing security. We also offer credit card authorization that will help you free up much of your time.

To know more about itilite, get in touch with our experts now.